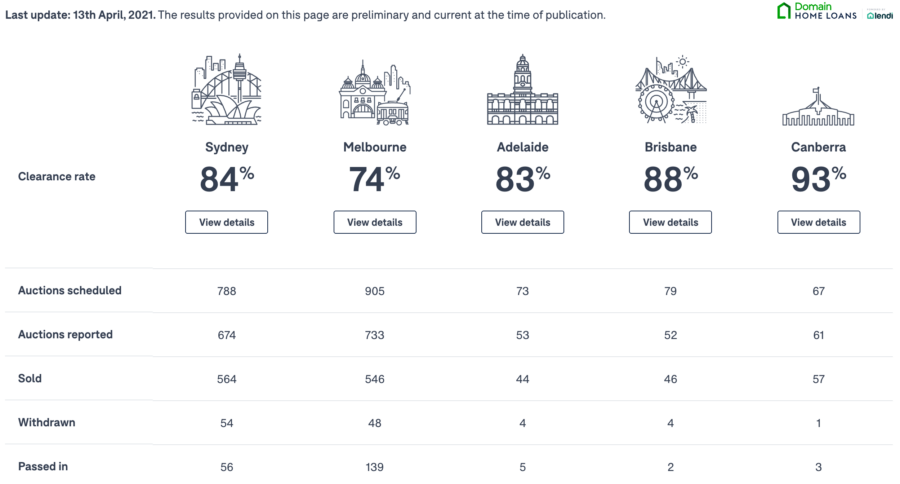

The median house prices around Australia rose by more than 2% for the month of February – the shortest month of the year. During March, the upward trend for prices showed no sign of abating. The market also showed other signs that is reacting to the current trend in prices. Last weekend, the last weekend for the month, saw very large numbers of properties offered for auction. Indeed, one market researcher observed that the number of properties offered for auction was the highest it had been since before Easter 2018. The large number of properties being offered for sale was then accompanied by very high levels of what are known as ‘clearance rates.’ The clearance rate is the percentage of properties offered for auction that are actually sold on auction day, either at the auction or in the immediate post-auction negotiation period. For all cities for which we have data, last weekend’s clearance rates were well above average. For example, in the five eastern mainland cities the clearance rates look like this:

Source: https://www.domain.com.au/auction-results/ – results from 10th April 2021

The results in Sydney and Melbourne are particularly influential, as these two markets dominate the national scene, particularly when it comes to auctions. Between them, Melbourne and Sydney accounted for 92% of the total number of properties for which auction results were reported in the five cities shown above. (Our apologies that we do not have data for the other mainland cities and Hobart; due to the Easter long weekend we have prepared this newsletter a little before the end of the month of March and data for all cities is typically released on the last day of the month). As a result of this dominance, the average clearance rate for the five cities shown above was 83.6%.

The escalating median house prices show that the volume of houses being bought and sold is now also very high, there can be no doubt that we are in the midst of a housing boom.

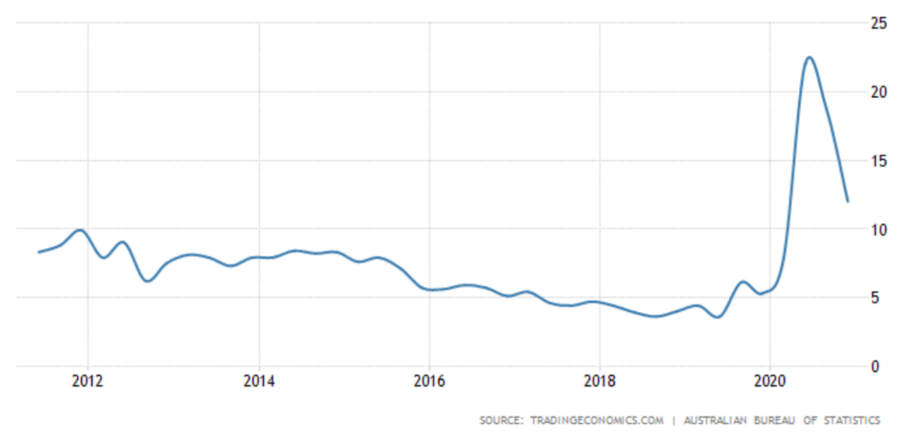

It is likely, the residential property boom is being driven by a combination of increased savings and very low interest rates. While in hindsight it makes perfect sense, in the early days of the covert pandemic few people would have expected that many Australians would become wealthier through the simple process of saving money. But 2020 was a year of record high personal savings. The following graph shows the average percentage of household income being saved over the last 10 years (source: ABS and Trading Economics):

During the main lockdown months, Australians were saving an extraordinarily high percentage of household income – well over 20%. There were two main reasons for this. Firstly, the Jobkeeper stimulus and other Commonwealth responses meant that a majority of people maintained at least some income during this period. Secondly, the lockdown meant that things upon which income would normally be spent, such as entertainment and travel, were simply not available.

And, of course, interest rates are historically very low and the Reserve Bank has repeatedly stated that it will act to keep rates low until at least the end of 2023. So, people are able to combine relatively large levels of their own savings with relatively cheap debt, allowing them to ‘bid up’ the prices of residential property.

A simple way to slow down demand in the property market would be, of course, to raise interest rates. However, the Reserve Bank doesn’t want to do this, particularly because allowing interest rates to increase is likely to have negative effects on business investment and Australia’s export industries.

Almost certainly, we will see some move towards greater restrictions on bank lending for residential property purchases in the coming months. It remains to be seen the extent to which such restrictions will slow the growth in residential property prices. Some slowing is necessary, however, because skyrocketing house prices are seeing an increasing number of Australians simply unable to afford to purchase property in their preferred capital city.

General Advice Warning – The above suggestions may not be suitable to you. They contain general advice which does not take into consideration any of your personal circumstances. All strategies and information provided on this website are general advice only. We recommend you seek personal financial, legal, credit and/or taxation advice prior to acting on anything you see on this website.

To read the full article – click here (https://www.everystep.net.au/files/resources/newsletter-april-2021.pdf)

Get in contact with a Chartered Accountant for advice contact us.